In today’s competitive job market, finding the right talent with the skills your company needs is more critical than ever. In this series of blog posts, we’ll explore key aspects of skills-based hiring and how it can help you build a strong and capable workforce. Crafting Effective Job Descriptions for Skills Creating compelling job descriptions…

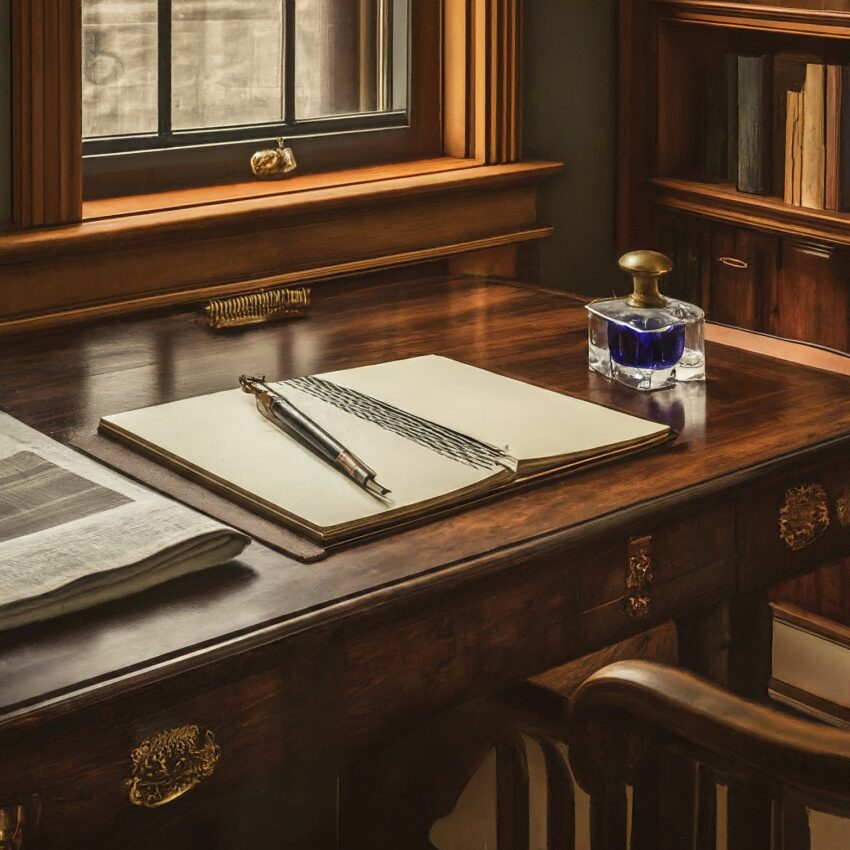

How I Use Generative AI to Enhance My Writing

AI tools offer powerful support for research and the writing process. Generative AI is artificial intelligence that can create new content like text, images, or music from simple instructions. It’s no wonder these tools are becoming so popular! They can do amazing things and keep improving. I’ve found a few generative AI products helpful for…

Why I Started Writing a Skills-First Talent Management Newsletter

Building Future-Ready Workforces Through Skills-Based Hiring The traditional ways we find, develop, and manage talent are broken. Using outdated signals like degrees and rigid job titles leads to bad hiring decisions and limits opportunities for many. It’s time for more companies to move to a Skills-First Talent Management approach. That’s why I started this newsletter….

Medicaid Expansion in Mississippi

Missing out or not? In Mississippi, John, a devoted husband and father of two, works tirelessly to support his family. Despite his hard work, his income hovers at just 120% of the national poverty level, making health insurance a financial burden beyond his reach. Having not expanded Medicaid, Mississippi leaves individuals like John in a…